how are rsus taxed in california

Tax liability of RSUs When RSUs are granted to you shares dont become rightfully yours until you meet the vesting requirements and any. How are RSUs taxed in the state of California.

How Equity Holding Employees Can Prepare For An Ipo Carta

With an all-in tax rate of 15 you only need to pay 150 for every 10 of RSUs that you vest into.

. Its important to understand the amount withheld on future rsus to avoid hefty tax charges afterward or even penalties. This rate is 238 20 plus the 38 tax on net investment income for high-earning taxpayers. If you sell your stock after your RSUs are converted to shares of the company youll be subject to capital gains tax as well.

Before going into detail about these two formulas lets define some terminology. Lets consider this example. If you live in a state where you need to pay state income taxes repeat steps 2 and 3 using your state marginal tax rate.

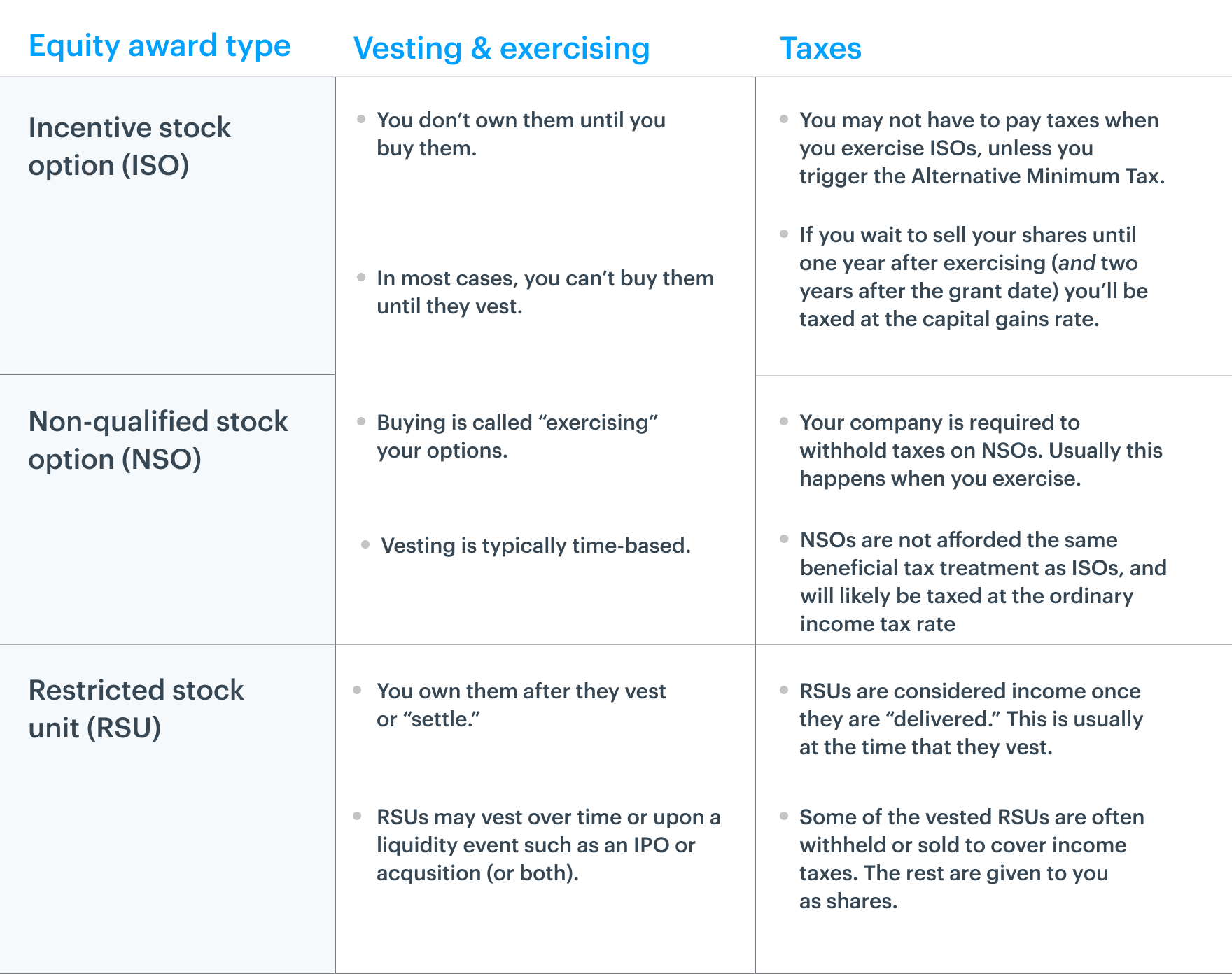

Heres the tax summary for RSUs. As the RSUs vest the value is taxed as income. Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs.

Sell to cover is the default arrangement and the best. Lets say one year has elapsed and you receive 30 shares of company stock of the 120 RSUs originally granted 25 per year vesting schedule. When you exercise NSOs you pay California income tax on the spread between your strike price and the current 409A.

In this guide we summarize how stock options are taxed in California covering the implications for ISOs NSOs and RSUs. Contrast that with a 45 all-in tax rate which requires 450 to vest into 10 of RSUs. How much will my RSUs be taxed.

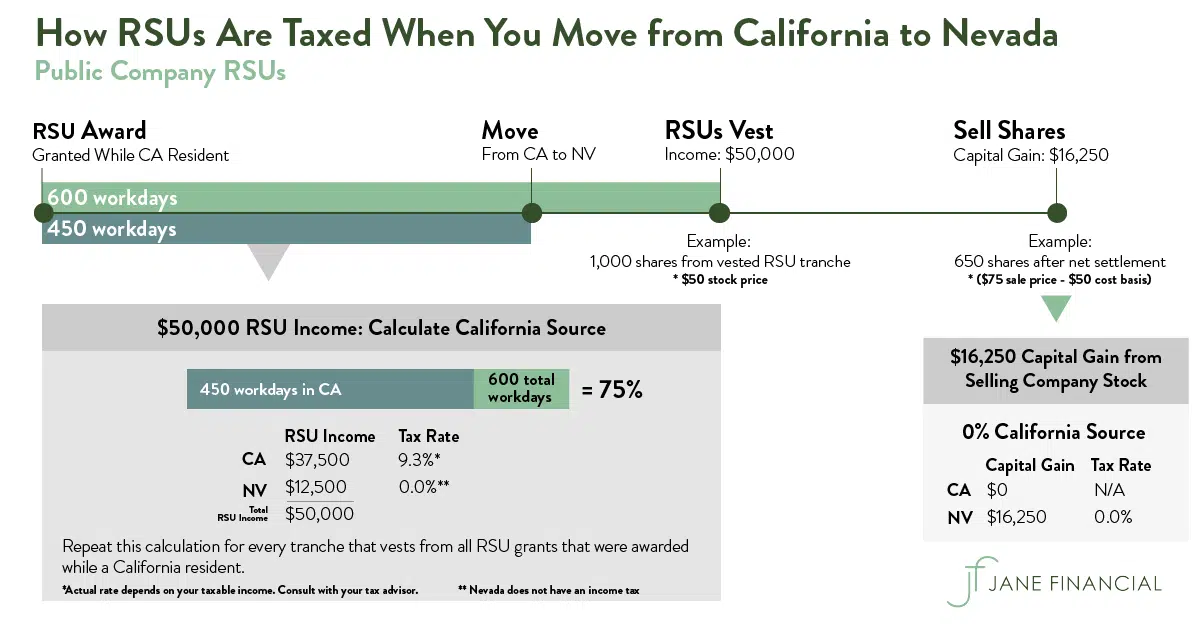

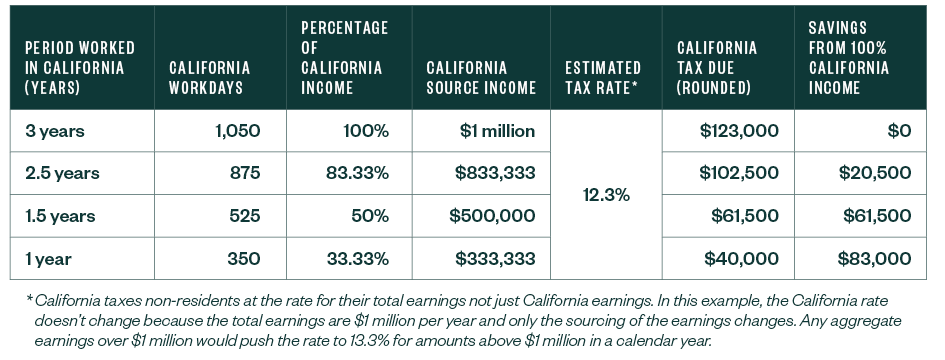

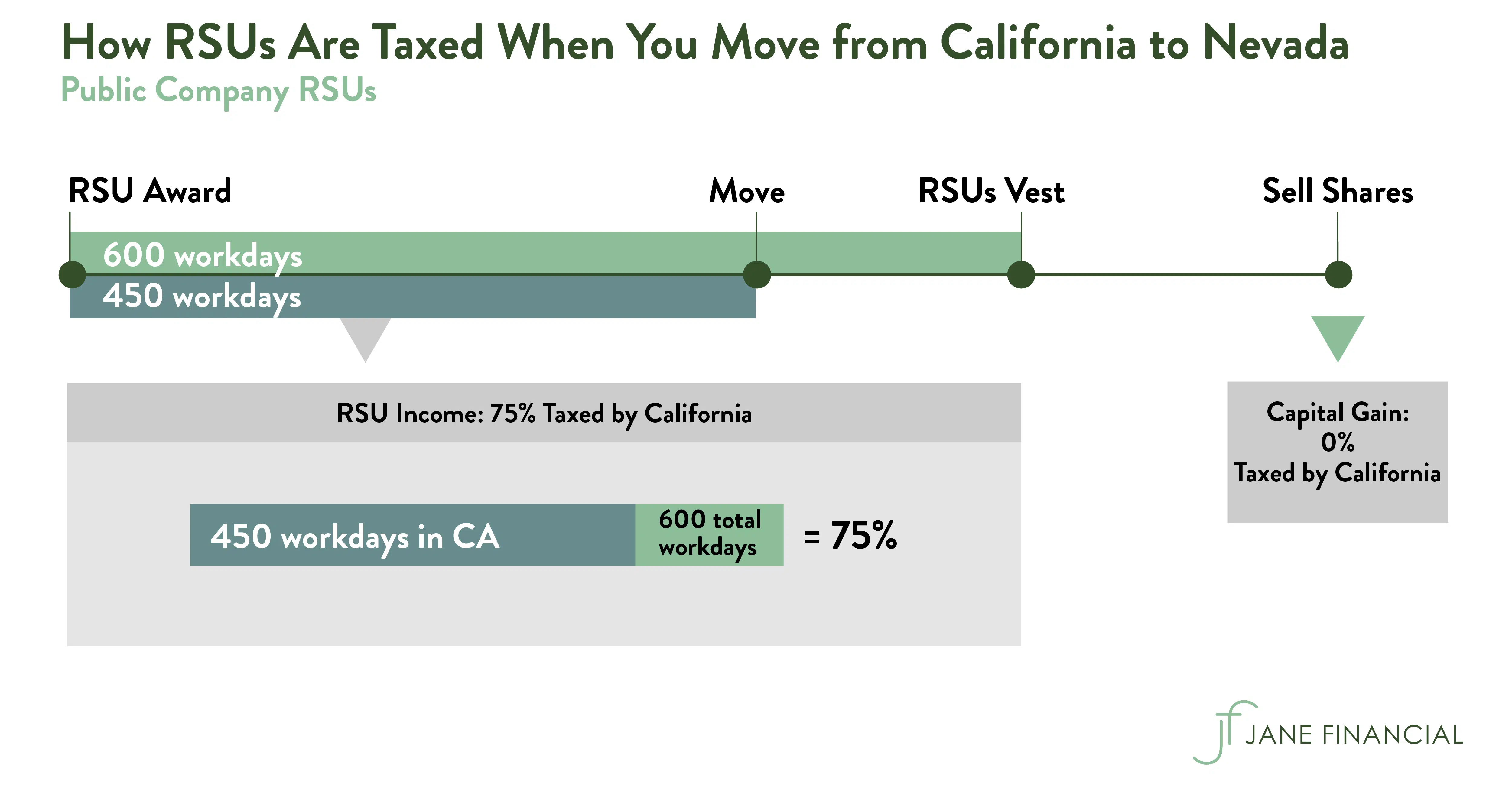

Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained. At vesting date California taxes the portion of the income from RSUs that corresponds to the amount of time you lived. On the other hand the rate for short term gains is the same as that for earned income which is 37 for high-income taxpayers.

RSUs can trigger capital gains tax but only if the stock holder chooses to not sell the stock and it increases. Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained. Your taxable income is the market value of the shares at vesting.

Hire date when the employee spouse started work at the company SD. Higher cost increases your risk. Your taxable income is the market value of the shares at vesting.

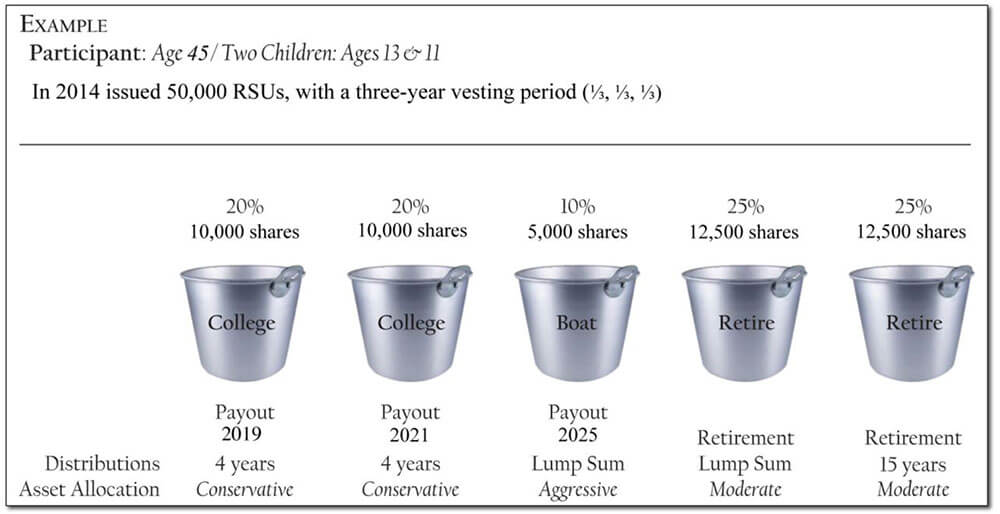

Not a resident of California granted equity of 6000 shares vesting monthly over 5 years ie 100 share per month for 5 years - January 2020. There are two main formulas that the courts in California developed to determine how RSUs are divided in divorce the Hug formula and the Nelson formula. Youll be required to pay the ordinary income tax rate on your gains.

On the other hand the rate for short term gains is the same as that for earned income which is 37 for high-income taxpayers. Say 10 rsus vest on one day and the stock price on that day is 5 per share. When you exercise ISOs you may owe California taxes if you trigger the AMT alternative minimum tax.

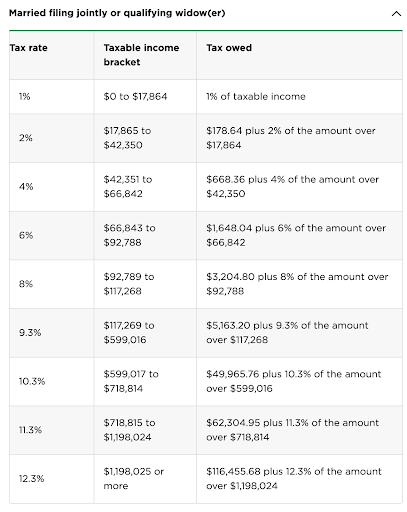

RSUs and Capital Gains Taxes. Ordinary tax on current share value. If youre in the 25 bracket and get 10k of RSUs youd pay about 25 federal tax and 9 state tax 35k.

Assuming a 35 Federal tax rate your total tax bill on these shares is 17500. Theyre taxed as ordinary income - so its based on your marginal tax bracket. The RSUs all vested in 2012 two years after the taxpayer became a California nonresident after moving abroad.

RSU compensation is taxed as ordinary income when the shares vest and based on your shares value on the vesting date. On the day that they vest that number of stock units is multiplied by the value of the stock on that day and that number is considered taxable regular income. Moves to California 100 shares vest this month.

Your RSU is for a specific number of stock units. 25 of these shares 1000 vest in June of 2022. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer.

Unlike stock options which. You will owe income taxes on it when you file your 2016 taxes next year. The share price is 5 0 on the vesting date this becomes your cost basis if holding the shares You owe taxes on 5 0000 of RSU income for 2022.

The total amount of rsus will show up. I have a question on how RSUs vest for non-residents who become temporary residents of California. A next April 15th or b by paying estimated taxes throughout the year.

On the other hand the rate for short term gains is the same as that for earned income which is 37 for high-income taxpayers. With RSUs you are taxed when you receive the shares. With rsus youre subject to california income tax when the shares are delivered to you.

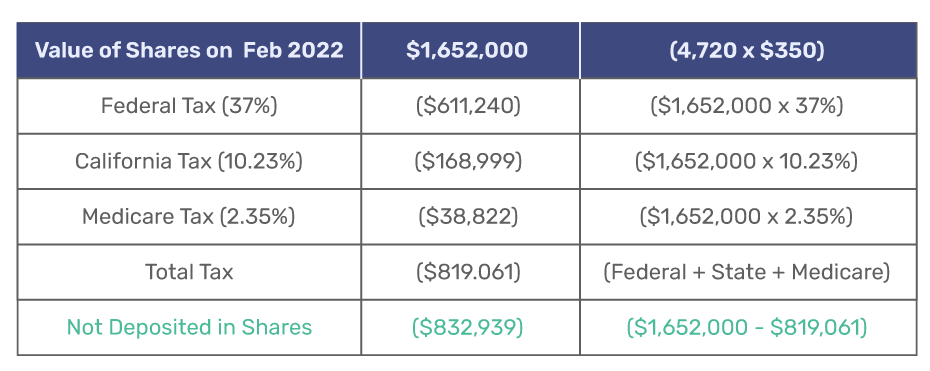

RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them. If you hold the stock for less than one year your gain will be considered short term. You have to pay taxes as soon as the RSUs vest and the IRS and FTB withholds several taxes using flat rates as defined by law eg 22 federal and 1023 California.

With rsus youre subject to california income tax when the shares are delivered to you. Assuming the stock price increased to 250 per share on 122020 you must pay income taxes on the RSU income of 7500 30250. Short-term capital gains tax ordinary income tax rates otherwise this includes immediate sale caution When you receive your shares you are taxed on.

If you have received restricted stock units RSUs congratulationsthis is a potentially valuable equity award that typically carries less risk than a stock option due to the lack of leverage. Those plans generally have tax. Originally reporting the full value of the RSUs on his California nonresident return the taxpayer subsequently filed an amended return and claimed a refund based on the stock price when he left California.

Separation date when the spouses. 4000 RSU shares were granted in June 2021. Long-term capital gains tax on gain if held for 1 year past vesting.

This rate is 238 20 plus the 38 tax on net investment income for high-earning taxpayers. If youre a high earner this withholding may not be enough and you settle up the balance. RSUs including so-called double-trigger RSUs are taxed as ordinary income from compensation when they vest.

Restricted Stock Units Jane Financial

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Restricted Stock Units Jane Financial

Sheryl Sandberg S Restricted Stock Units Zoe Financial

How State Residency Affects Deferred Compensation

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Restricted Stock Units In Nqdc Plans Executive Benefit Solutions

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

California Income Tax And Residency Part 2 Equity Compensation And Remote Work Parkworth Wealth Management

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Units Jane Financial